Office Furniture retailers, wholesalers and e-commerce brands in Mexico, Brazil, Latin America and worldwide, need to be aware of emerging trends that are shaping the new furniture industry landscape in order to take advantage of these changes.

Fundamental shifts in Latin American consumers’ buying preferences can pose new challenges but can also open doors to new opportunities for those willing to adapt. By understanding these changing industry trends, furniture resellers can capitalize on these changes to position their business for continued success.

In this blog we will explore the challenges for office furniture retailers in Latin America and their solutions.,

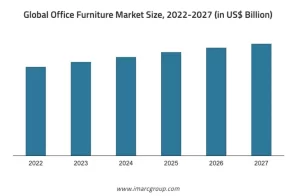

The global office furniture market reached a value of US$ 58.4 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 74.7 Billion by 2027, exhibiting a CAGR of 4.1% during 2022-2027. The office furniture market in Latin America is also very large with the largest markets being Brazil and Mexico followed by Argentina, Venezuela, Colombia, Chile, Costa Rica, Ecuador, Guatemala, Panama, Paraguay, Peru and Uruguay.

Top office furniture manufacturing companies include Herman Miller, Steelcase and Urban Office but there is a very large spectrum of people who cannot afford to pay more than a thousand US dollars that these brands cost. Therefore alternate manufacturing locations like China, India, Turkey, and Vietnam have emerged as manufacturing hubs, and today over 40% of the world’s office furniture is made in China alone by companies like Stellar. There is also a lot of local manufacturing happening in Latin American countries, which has resulted in industry leaders like Tok&Stok, Mobly, and several others.

Due to the COVID-19 pandemic and changing consumer behaviors, the furniture manufacturing industry is witnessing a variety of challenging trends:

A lot of people today are averse to buying and owning things so renting or leasing has become a preferred way of using goods/services and led to many innovative models like rent-to-own which itself is worth about $8.5 billion annually and is increasingly growing among consumers.

Heightened unemployment and decreasing consumer spending as a result of the COVID-19 pandemic have curbed discretionary purchases, such as new furniture, and have negatively affected demand. In addition, income constraints are expected to amplify price-based competition between domestic operators and foreign import substitutes, contributing to industry consolidation.

The Russia Ukraine crisis has lingered on for several months now, and with recession looming on the horizon, we are undoubtedly faced with macro-economic trends that nobody can pinpoint with certainty.

Online retailing will continue to be a preferred buying channel – nearly 15-20% furniture today is bought online and it is an increasing trend. By utilizing the internet and social media, millennials tend to be skilled comparison shoppers and will spend a couple of weeks researching products before making a purchase. This means office furniture manufacturers will need to tailor their products to these online platforms and include details – and options – for their younger prospective customers.

But there is also some good news – the expected revenue is on the rebound in 2022 due to increased consumer spending with returned employment and boosted demand for industry operators. Furniture and home furnishings consumption growth through the first five months of 2022 increased 31% from the same period the previous year.

By taking advantage of the solutions mentioned below, furniture retailers and wholesalers can position themselves for continued success and growth in an evolving market.

Renters are likely to look for more affordable furniture options in the same manner as landlords will opt for more cost-effective furniture when they lease their offices/homes with a growing number renting their furnishings rather than outright buying them. To turn this challenge into an opportunity, furniture brands may want to add more items to their inventory of inexpensive, streamlined, or multipurpose furniture to suit these smaller living spaces, as multifunctional furniture is rapidly gaining popularity.

Furniture brands need to diversify their products to cater to the specific needs of each demographic group. While this may mean additional investment in new design and innovation, it also creates new possibilities for additional revenue sources. Huddle up with your sales and marketing teams and your office furniture manufacturing partner to find out what styles, materials and trends are popular in different regions or your own and adjust your furniture purchase buy plan to get more fast-selling products that improve your revenue to inventory ratio.

Online retailers have taken away a good portion of the market share of brick-and-mortar retailers – especially since pandemic restrictions kept everyone home. This move from physical to virtual platforms was already gaining momentum before 2020, but now virtual selling is more important than ever for furniture brands to start embracing online and mobile technology. This increase in online shopping means an opportunity to sell to online retailers that are not limited to a physical geographic area. Check with your furniture manufacturer if they can provide e-commerce-friendly product images, videos, titles, descriptions, assembly instructions, etc., that will make your office furniture e-commerce business more successful.

Summary

While these are a few of the recent challenges and trends affecting the Office Furniture industry, the market will continue to change as new technologies are introduced throughout the future. By adopting these solutions – and an adaptive mindset – furniture brands can position themselves for success through change.

If you are an office furniture retailer or interior designer/architect in #Brazil #Mexico #Argentina #Venezuela #Colombia #Chile #CostaRica #Ecuador #Guatemala #Panama #Paraguay #Peru or #Uruguay and are looking to buy new furniture, you must contact Stellar who is a leading multi-national #OfficeFurniture manufacturer in China. We also undertake end-to-end commercial projects for large commercial spaces and universities.

Stellar has been in the business for the last 32 years and exports to over 100+ countries across the world, from its factories in China and India. To discuss the needs of your organization and see how we can be of service. Write to us at contactus@stellarglobal.com

Stellar Global is a leading international office furniture manufacturer and supplier with over 34 years of industry experience, crafting ergonomic chairs, desks, workstations, and commercial furniture shipped to customers around the world.